Riviera Wealth Group – Riviera Wealth Partners

Riviera Wealth Financial Planning Pty Ltd, Tim Ching, Stefan Duro, Sue-Ellen Hogan and Magdeline Baramilis are Authorised Representatives of R&S Wealth Group Pty Ltd T/A R&S Wealth Group AFSL 540872

- February 23, 2022

- One Eleven Media Design

Timing Risk

If you have money to invest, you want to ensure that your investment will perform. Trying to make decisions yourself on the fly in an ever-changing share market is not for the faint-hearted.

We hear that share market investors are inevitably in for a bumpy ride during times of economic uncertainty. Even when times are good, share prices in larger companies can rise and fall daily. This invariably creates a risk that investors might buy shares on a day when prices are temporarily high. And that’s what is known as Timing Risk.

Unfortunately, the news is not good for investors because the value of their investment can diminish. They purchase fewer shares for a given amount of money, and when the market does recover, their investment doesn’t do as well as expected.

Managing the Timing Risk

Riviera Wealth Partners can help you to manage Timing Risk. Using what’s known as Dollar Cost Averaging, the idea is to purchase shares at different times. Dollar Cost Averaging reduces the effect of any particular day on which an investment takes place. It’s very similar to how diversifying a portfolio reduces the impact of any one company’s performance on that portfolio.

As an example, if an investor has $120,000 and invests that money all at once, they create the risk of investing 100% of their portfolio at what could be high prices. A better option is to divide their investment into 12 x $10,000 parcels and then invest one per month over a year. Invariably, some months, prices will be high, and they buy fewer shares, while in others, prices will be lower, and they can buy more shares.

When to use Dollar Cost Averaging

Dollar Cost Averaging is a strategy used when investing in share or share-based investments mainly because it’s possible to purchase smaller parcels of this type of investment. It works especially well if you’re investing a substantial amount of money over the long-term; better when a market is falling and not so well in a rising market.

The problem, of course, is that no one can predict if the market is about to rise or fall. However, most investors believe the benefits of Dollar Cost Averaging in a falling market exceed the disadvantages in a rising market.

Automatic Dollar Cost Averaging

You may not realise it, but Dollar Cost Averaging may already be part of your investment strategy.

This is because regular employer contributions into super funds are then invested in the share market at multiple times. And, because super contributions occur over many years, so too does Dollar Cost Averaging, meaning this is about as good as it gets when it comes to reducing Timing Risk.

The long-term effect of shares

While this may be the subject of another, much longer blog, at Riviera Wealth Partners, we believe investing in the share market over the long term pays handsomely. Even though there is so much going on in the world currently, we advise our clients to take a long-term view of investing that ultimately helps them create wealth and achieve their financial goals.

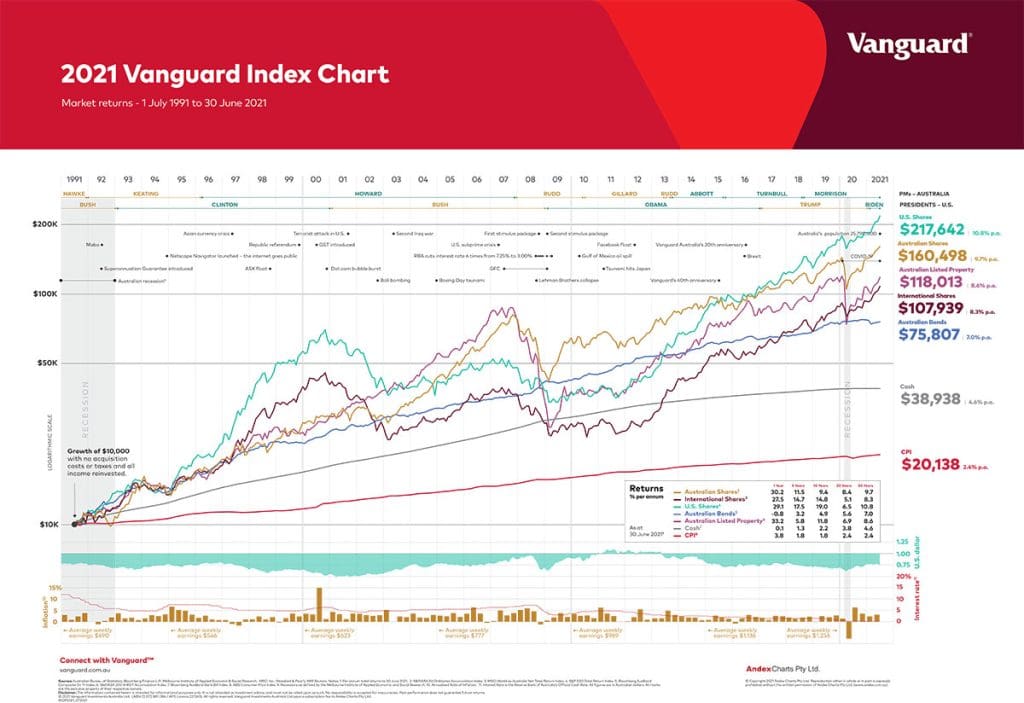

To help keep things in perspective, we’d like to share Vanguard’s 2021 Index Chart. The chart shows the long-term performance of different asset classes and powerfully illustrates that, while markets fluctuate day to day (and even year to year), asset values have steadily increased over the past 30 years.

What do I need to do now?

Riviera Wealth Partners provide tailored Financial Planning and Insurance advice to safeguard you and your family’s financial future.

For more information on Timing Risk and how it can affect your investment, please contact us. If you have money you’d like to invest or you would like us to review your share portfolio, we can explain the benefits of Dollar Cost Averaging and its positive effect on your overall financial goals.

Meet Our Team

Tim Ching

Senior Financial Adviser

Stefan Duro

Senior Financial Adviser

Sue-Ellen Hogan

Risk Specialist

Magdeline Baramilis

Associate Financial Adviser